En un mundo donde la estética visual es fundamental, el neón personalizado se ha convertido en una herramienta poderosa para destacar tu marca. En Madrid Comunicación, nos especializamos en ofrecer servicios de diseño e impresión de rótulos en Madrid, creando piezas únicas que capturan la atención y reflejan la esencia de tu negocio.

Nuestro equipo de expertos en diseño colabora contigo para entender tu visión y traducirla en un impactante diseño de neón. Ya sea que necesites iluminar tu tienda, añadir un toque especial a un evento, o crear una pieza decorativa para tu hogar, nuestros letreros de neón son la opción perfecta. Utilizamos tecnología de vanguardia y materiales de alta calidad, asegurando que cada pieza no solo sea hermosa, sino también duradera y eficiente.

El neón personalizado no solo agrega un ambiente vibrante, sino que también se convierte en una herramienta de marketing efectiva. Un letrero llamativo tiene el poder de atraer a más clientes y generar un reconocimiento instantáneo de tu marca. En Madrid Comunicación, garantizamos que tu diseño sea único y memorable, convirtiendo tu idea en una verdadera obra de arte luminosa que se destacará en cualquier entorno.

Comprendemos que cada cliente tiene necesidades específicas, por lo que ofrecemos un enfoque personalizado en cada proyecto. Te mantenemos informado en cada etapa del proceso, desde el concepto inicial hasta la instalación final, asegurando que el resultado supere tus expectativas y se ajuste perfectamente a tu visión.

Si estás buscando una forma innovadora de destacar tu negocio en el competitivo mercado actual, no dudes en contactarnos. En Madrid Comunicación, estamos listos para ayudarte a iluminar tu marca con un diseño de neón personalizado que dejará huella. ¡Dale a tu espacio un toque especial y atrévete a brillar con nosotros!

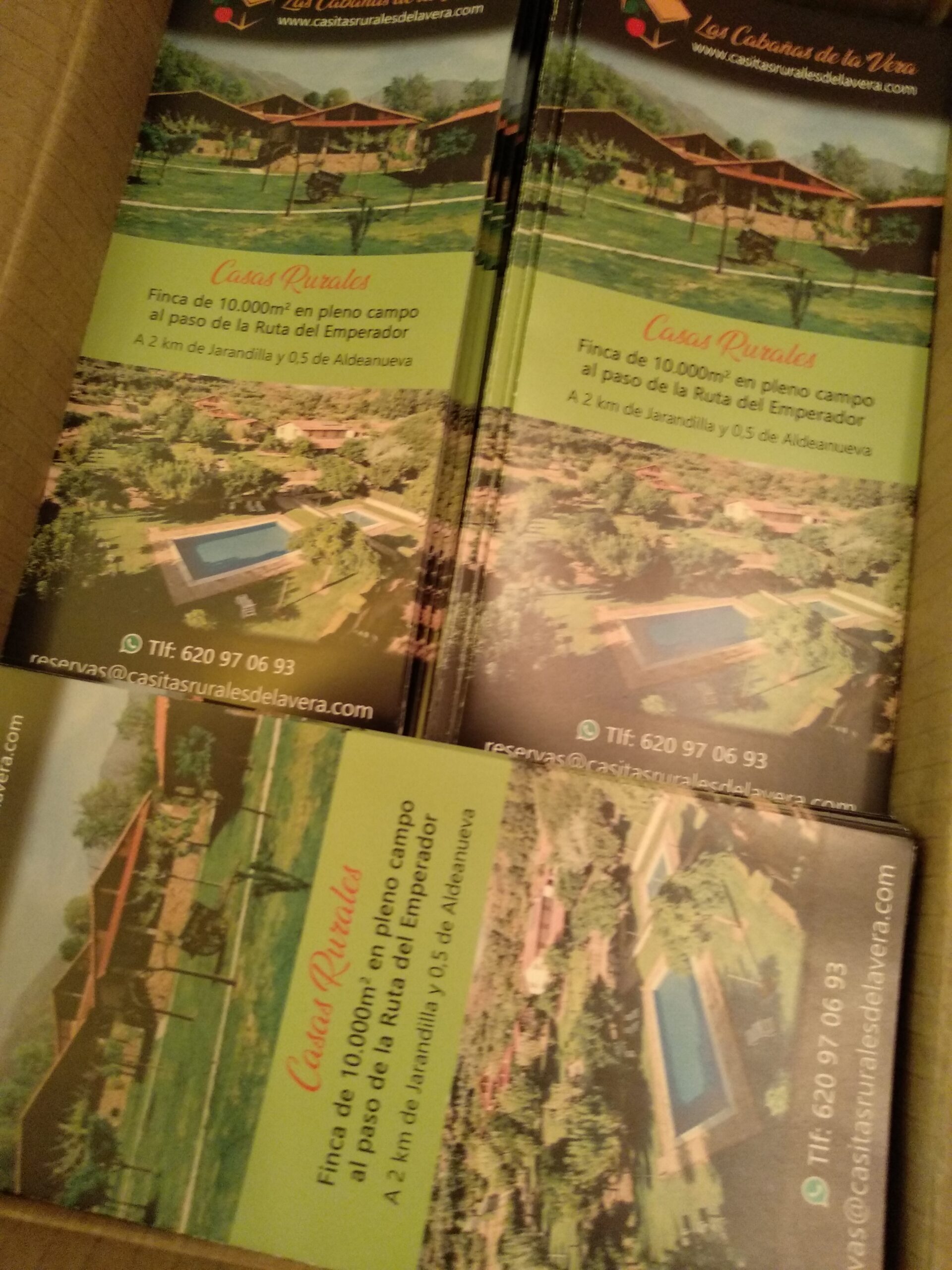

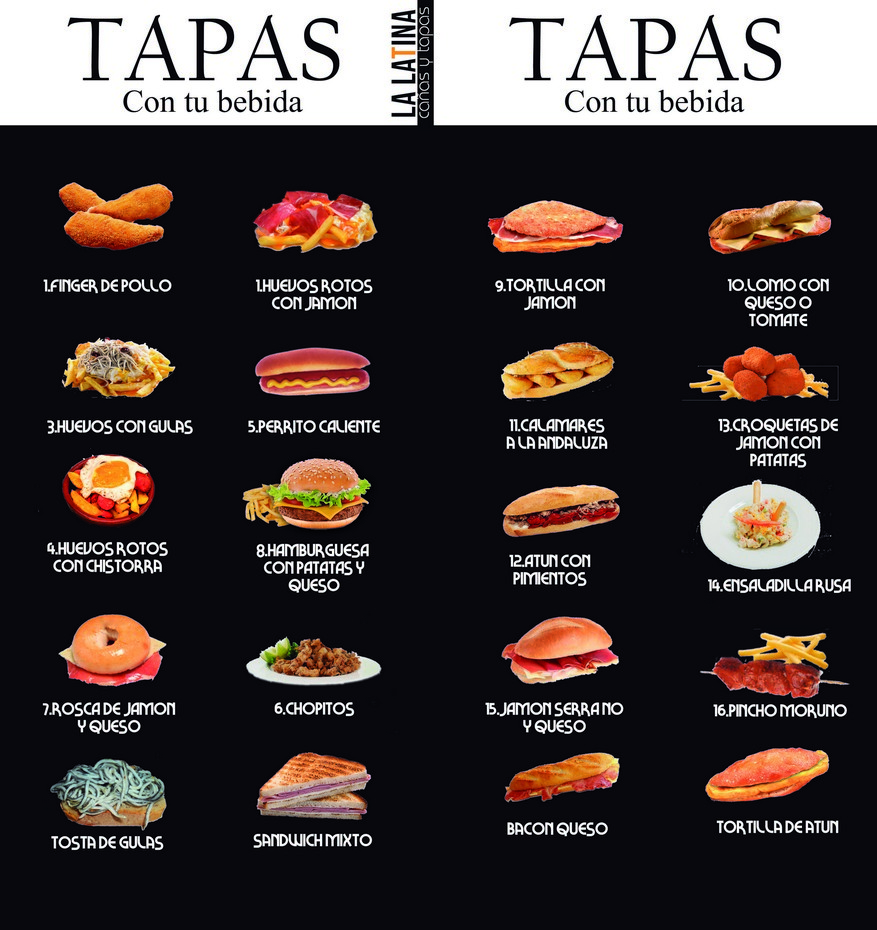

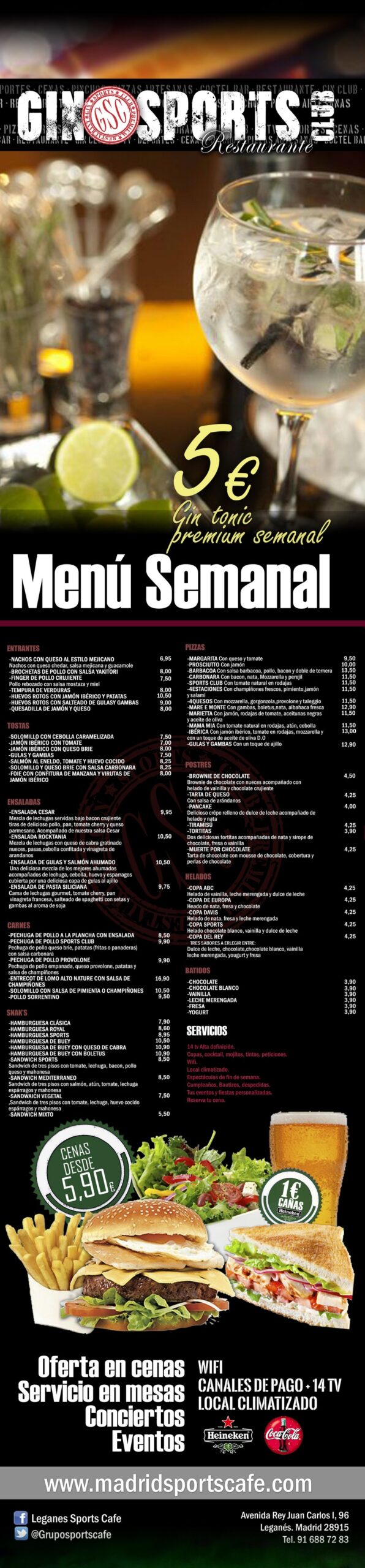

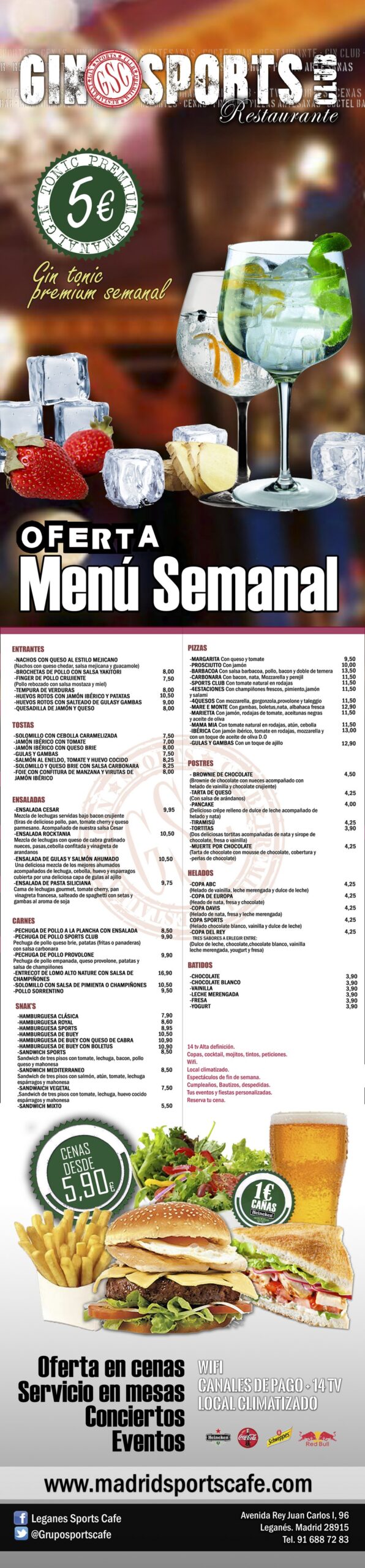

A continuación te mostramos algún trabajo que hemos realizado de impresión de rótulos en Madrid.